Deriv P2P App

I led the team to design Deriv's P2P payment platform in 2021, solving deposit issues for underbanked users. In September 2025, I led a redesign to modernize the interface while preserving the trust-building features that made it successful.

My Role

As UI/UX Manager, I:

- •Led user research with underbanked users across Africa and Asia

- •Designed the end-to-end P2P marketplace experience

- •Created trust and safety features including escrow visualization and rating systems

- •Collaborated with compliance and payments teams to ensure regulatory compliance

- •Led the September 2025 redesign to modernize the interface and improve visual consistency

The Messages We Couldn't Ignore

Interested traders from Africa and Asia wanted to use Deriv, but traditional banking was failing them. In many countries, people struggle to even open bank accounts, international transfers are expensive or flat-out blocked, and getting foreign currency means dealing with complicated regulations.

The Underbanked Reality

What I learned from support tickets

High Barrier to Entry

Many citizens in emerging markets can't open traditional bank accounts

International Transfer Restrictions

Banks often block or heavily restrict cross-border transactions

Growing Interest in Trading

Despite barriers, demand for online trading was increasing rapidly

Listening to Those Left Behind

I led my team to reach out to users who'd contacted support about deposit issues. Through interviews with people across Nigeria, Kenya, South Africa, Pakistan, and other emerging markets, we asked: "If you could access Deriv, how would you want to deposit and withdraw money?"

How Users Already Handled Money

Used mobile money services like M-Pesa for daily transactions

Paid others to top up their online shopping accounts such as Amazon

Used peer-to-peer cryptocurrency exchanges

Relied on payment agents for forex transactions

What Users Wanted from Us

Ability to use local payment methods they already trusted

Fast transactions (ideally within minutes, not days)

Transparency about exchange rates and fees

Security guarantees that their money was protected

These insights changed everything. Users weren't asking Deriv to become a bank. They wanted Deriv to connect them with each other. Peer-to-peer exchange was already part of how they handled money outside of Deriv. They just needed a safe, efficient platform to do it.

Solving the Trust Problem

Building a peer-to-peer payment platform sounds straightforward until I hit the core challenge: how do I make strangers trust each other with money? In traditional P2P platforms, scams are everywhere. One wrong design decision and we'd build a fraud playground instead of a payment solution.

Design Principles

Three pillars of trust

1. Transparency First

Show everything. Exchange rates, payment methods, transaction limits, user ratings. No hidden fees, no surprises. Users needed complete visibility before committing to a trade.

2. Built-in Safety

Escrow wasn't optional, it was the foundation. Money locks when an order is placed. Only releases when both parties confirm completion. Visual indicators at every step.

3. Reputation Matters

Every transaction earns a rating. Good traders build reputation. Bad actors get exposed. The community polices itself through visible feedback.

Features That Built Trust

Automated Escrow System: Buyer's View

The buyer pays the seller using whatever method they agreed on (bank transfer, mobile money, whatever works) and uploads proof like a payment slip. The seller checks their account, confirms they got paid, and then Deriv releases the escrowed funds to the buyer. Both sides have to confirm before money moves anywhere. Simple as that.

As a buyer, I want to buy USD from the seller...

As a seller, a buyer has placed an order with me...

Automated Escrow System: Seller's View

When a buyer places an order, Deriv locks the seller's funds right away. Say you're selling $100. Someone buys $50 from you. That $50 gets locked in escrow instantly, so other buyers can only see the remaining $50 available. No double-selling, no confusion about what's actually up for grabs.

Community-Driven Ratings

After every transaction, both parties can rate each other. These ratings are permanently visible on user profiles. Good traders build up positive reviews. Problematic users get flagged. The community quickly learns who to trust.

The system also tracks completion rates, average response times, and transaction limits that increase with good behavior. Trust isn't just given, it's earned through consistent, positive interactions.

User ratings and transaction history

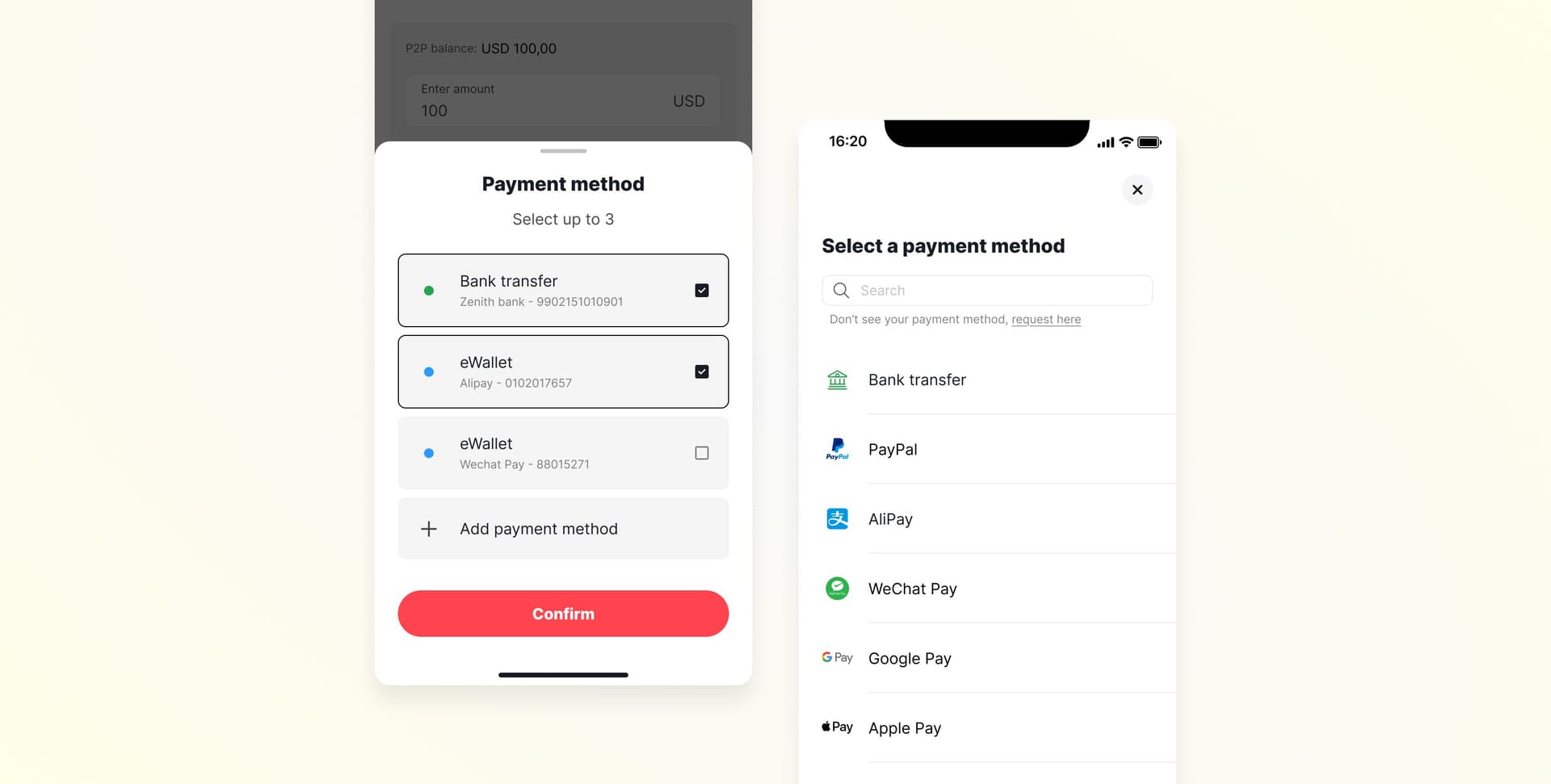

Wide variety of payment methods supported

106 Payment Methods

Instead of forcing users into specific payment channels, Deriv P2P integrated 106 different payment methods. Mobile money, bank transfers, digital wallets, cash pickups, anything traders wanted to use. M-Pesa, Alipay, PayPal, Google Pay, WeChat Pay, local bank transfers.

Advertisers specify which methods they accept. Buyers filter by their preferred method. The platform facilitates the connection but doesn't tell people how to transfer money. Flexibility was key.

No Anonymous Trading

Before anyone can create their first P2P ad or place an order, they have to complete identity verification. No anonymous transactions allowed. This wasn't just about compliance, it was about creating accountability.

The platform includes dual-layer verification for every transaction as an extra security measure. Users appreciated knowing everyone on the platform was verified, even if it added some friction to getting started.

Identity verification required before trading

The Unexpected Discovery

Deriv P2P was built to solve a deposit problem, a gateway to trading. But users had other ideas. They started using P2P not just to fund trading accounts, but as a standalone currency exchange service.

What Deriv P2P Was Built For

A way for underbanked users to deposit funds so they could start trading on Deriv platforms. Simple deposit/withdrawal functionality.

Expected use case: Deposit → Trade → Withdraw

What Users Actually Did

Used it as a currency exchange marketplace. People exchanged local currency for USD and vice versa, often without ever touching the trading platforms.

Actual use case: Exchange currency → Done

Impact

Accessibility

Markets where users can now access Deriv using local payment methods

Active Traders

Increase in active trading accounts from underbanked markets

Reactivated Users

Previously inactive accounts from underbanked markets started trading again via P2P

Deriv P2P proved that financial inclusion isn't about lowering standards or creating separate experiences for underbanked users. It's about building systems that support the way people already handle money, while maintaining high security standards.