How Deriv Works Uniquely

Deriv offers various trading accounts with specific platforms, assets, and trading options (CFDs or Options). We leveraged this by allowing clients to list their trading accounts on a marketplace for others to invest in.

Convert to Earn More

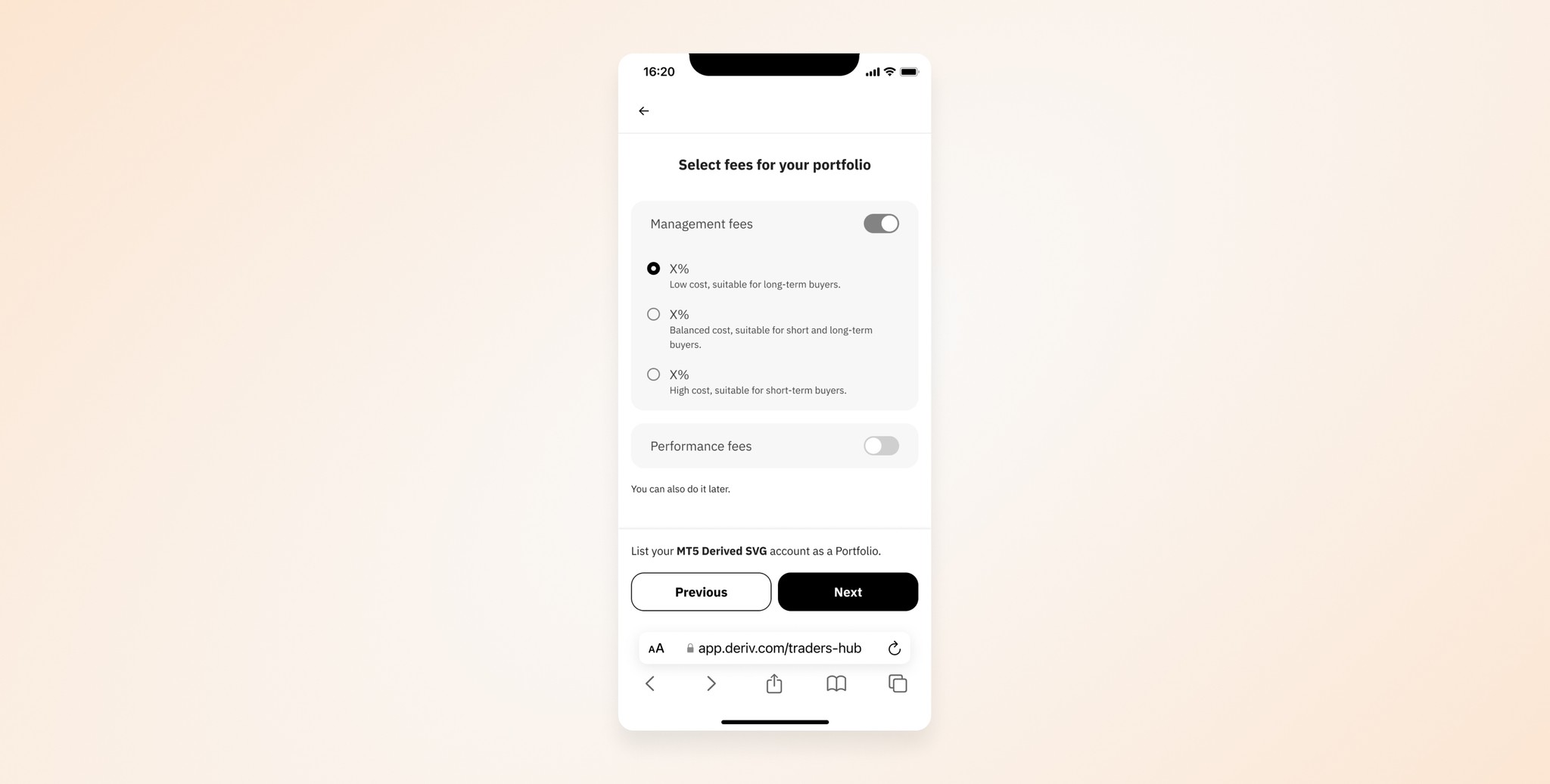

Portfolio managers can attract investments, providing more funds for strategic trading to maximize returns. Additionally, converting an account into a portfolio allows managers to earn management or performance fees from investors.

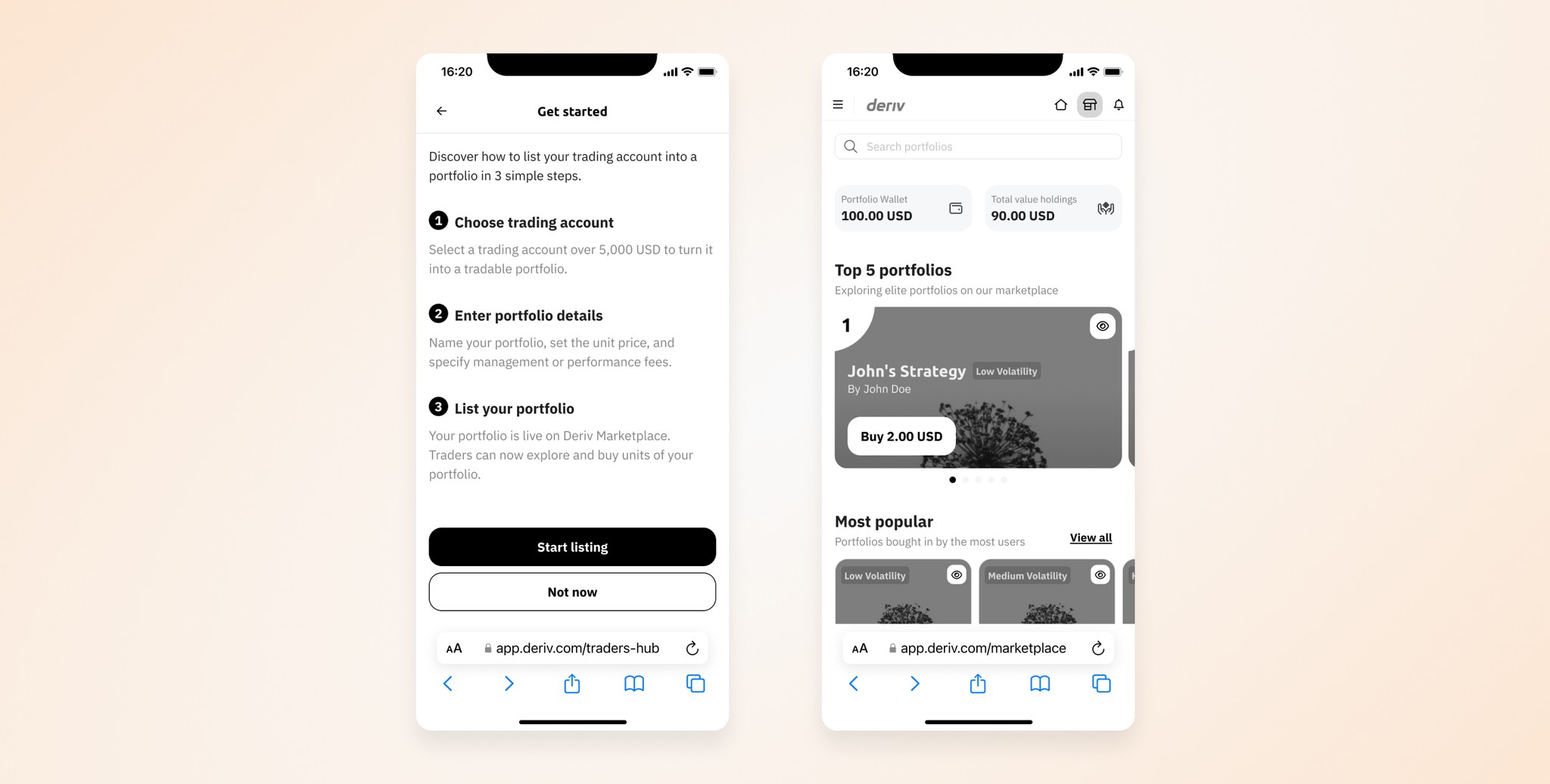

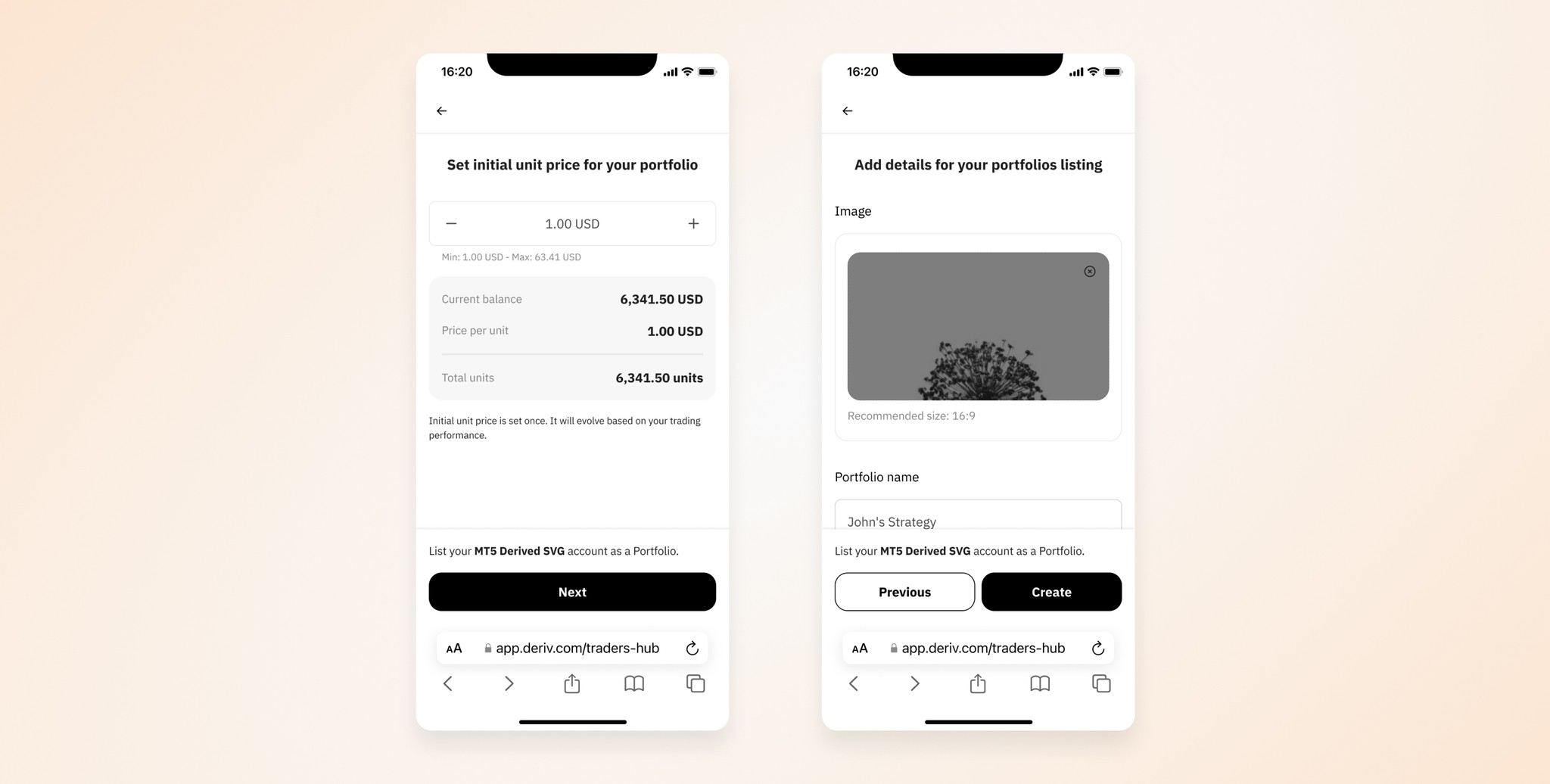

Listing Trading Accounts as Public Portfolios

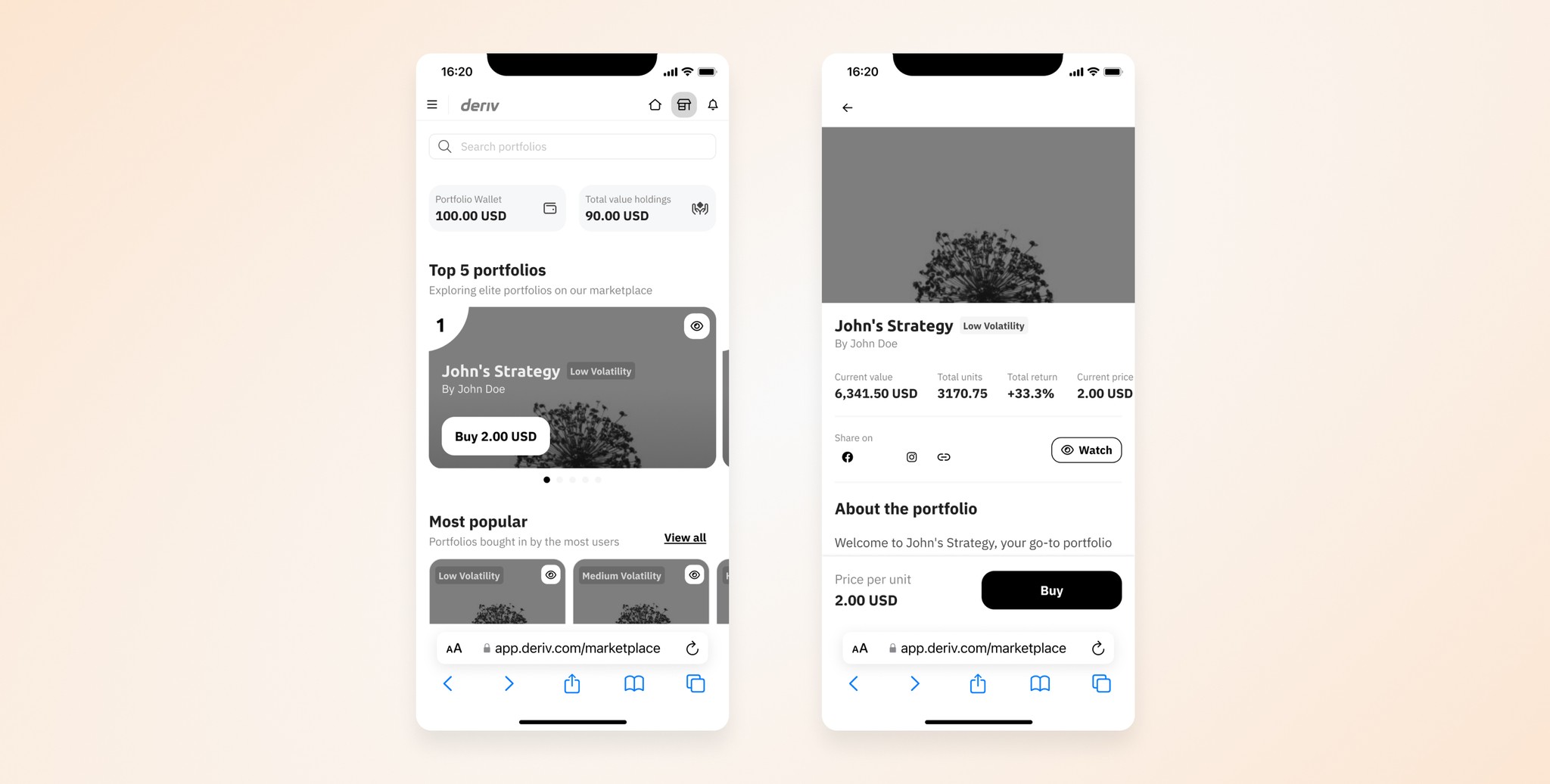

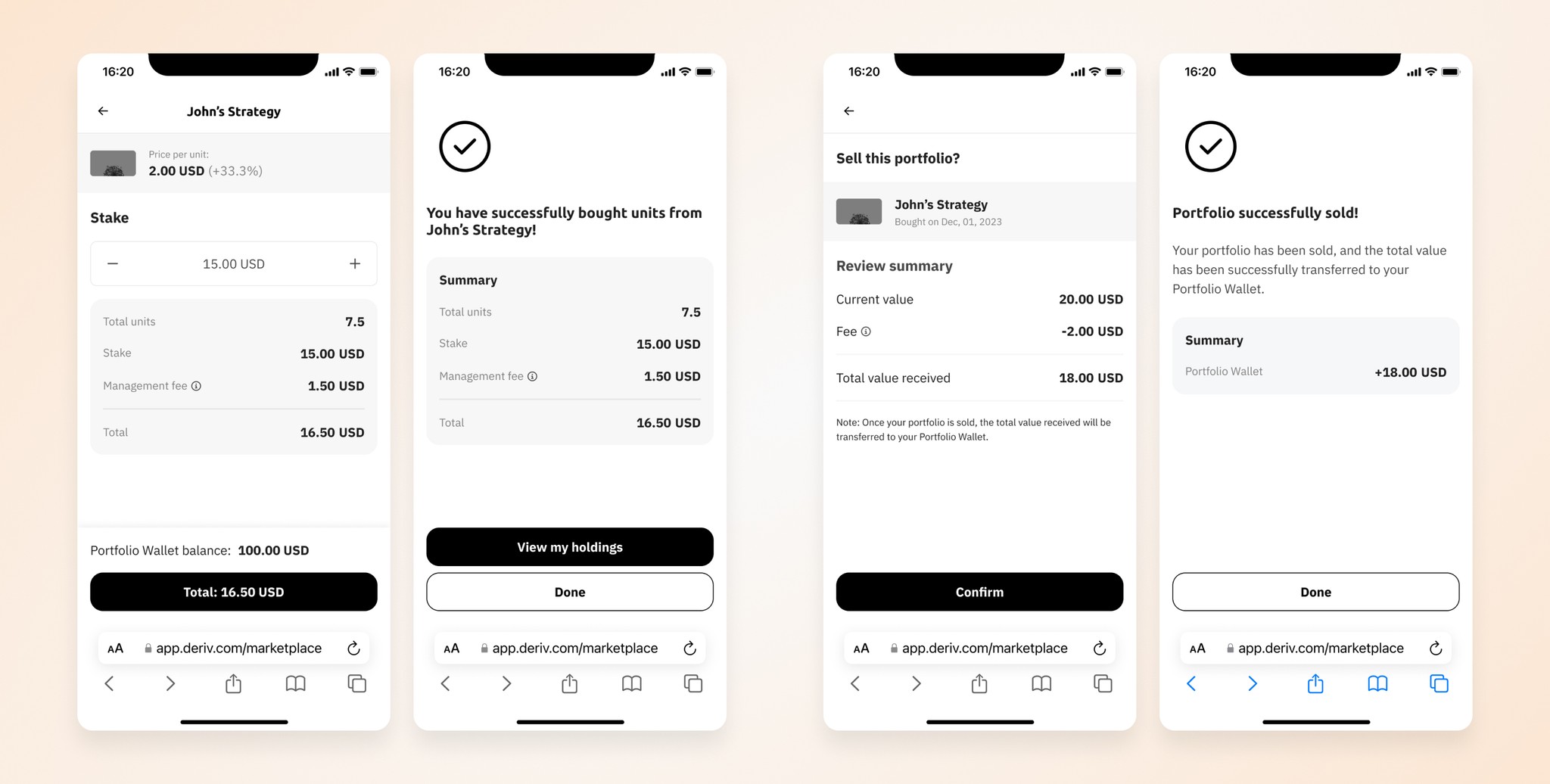

Eligible portfolio managers can set unit prices for their portfolios, calculated based on the account's current net value. Unit prices fluctuate with the account's performance, similar to listing a stock. Successful management leads to portfolio growth, benefiting investors.

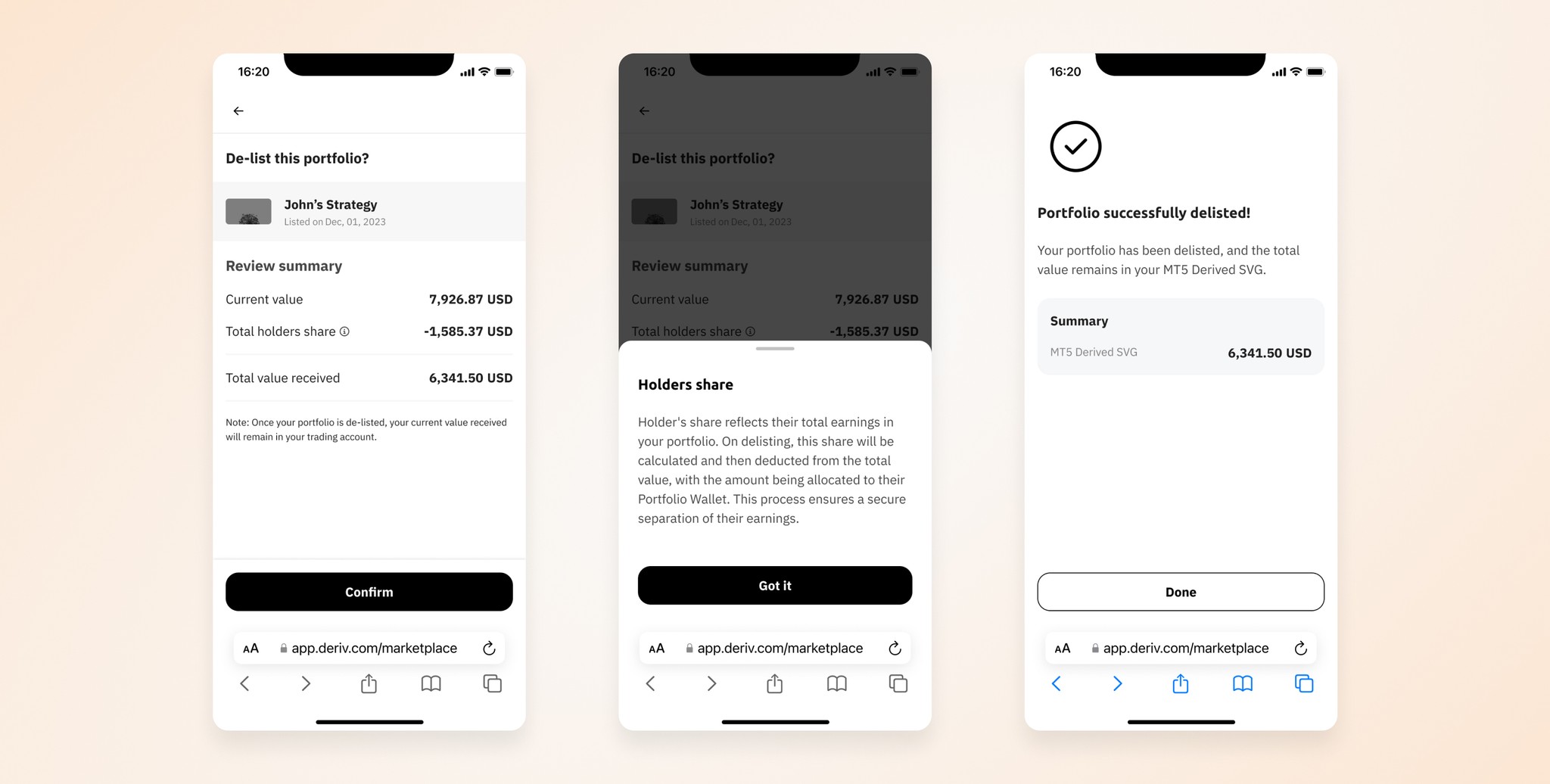

Delisting a Portfolio

Portfolio managers can delist their portfolios, releasing funds to holders based on their shares. Once delisted, the account becomes private again, with no public performance visibility.

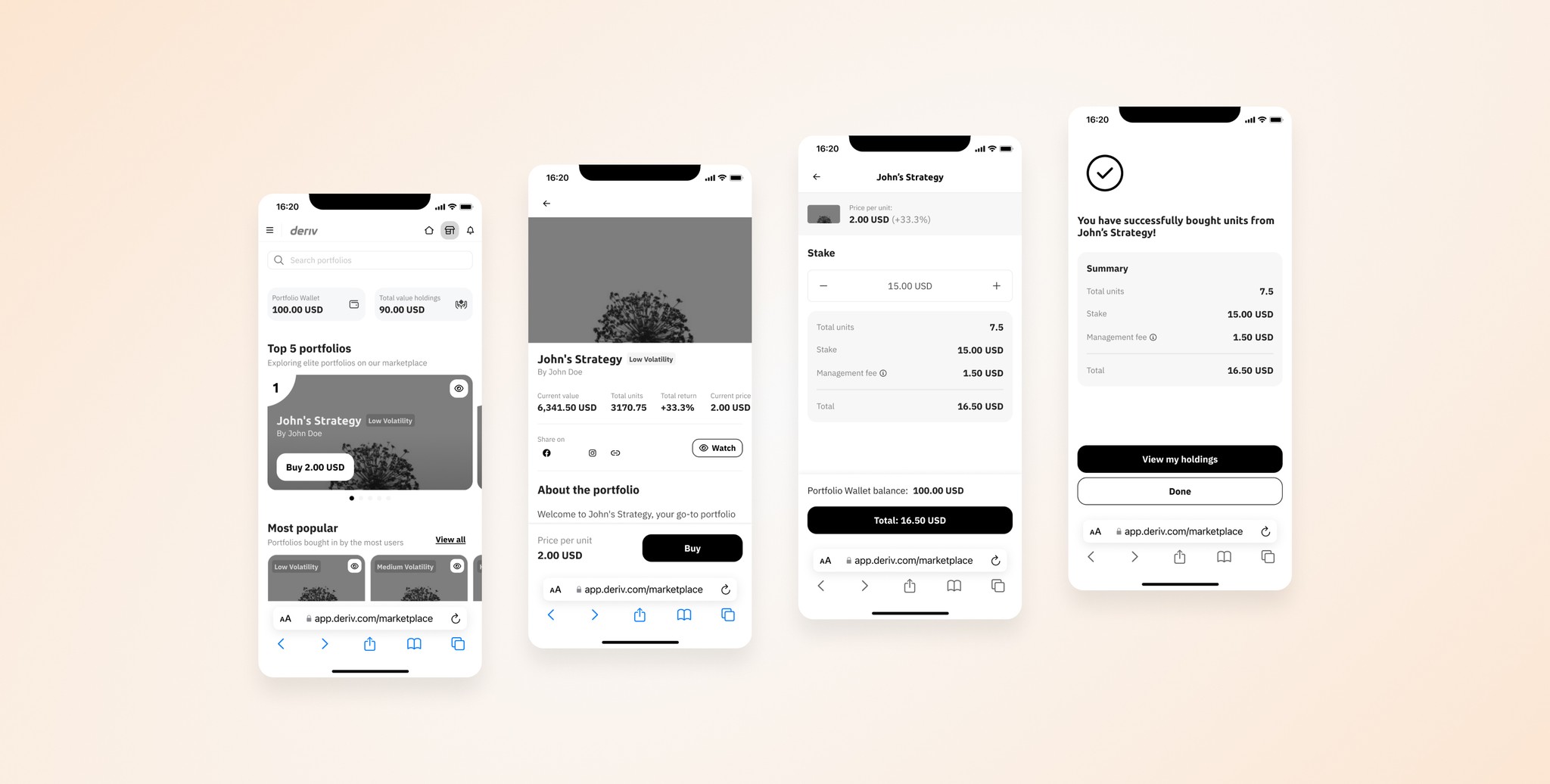

Marketplace

Traders can explore and compare portfolios on the marketplace, viewing details like unit prices, total units, values, returns, number of investors, traded assets, and performance. This helps them make informed investment decisions.

Buying and Selling Units as Holders

Collaborating with Profitable Traders

To ensure success, we engaged top traders worldwide to test our lo-fi prototype and made them the first 100 portfolio managers. Their enthusiasm and positive feedback were invaluable. Below are all the mockups for your reference.

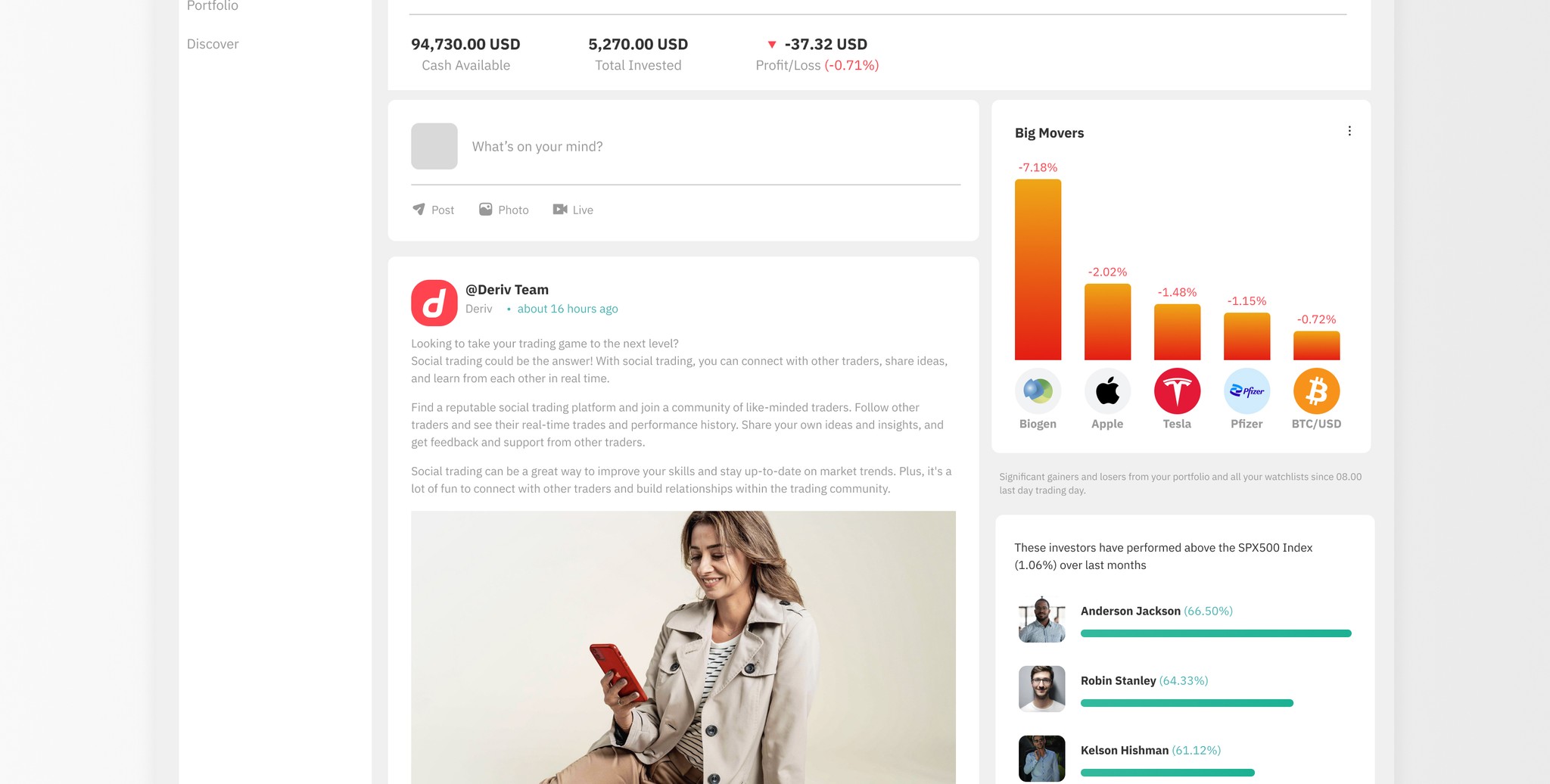

Ideas for the Future: Social Space

To complete the portfolio listing feature, we plan to design a social space where traders can post updates, stream live videos, and interact with investors. This will foster closer relationships and increase exposure.